Yesterday, Sanofi U.S. made an announcement: Effective on July 1, 2022, the company will lower out-of-pocket cost of insulin for uninsured patients and expand access in underserved communities (in reality, the lower prices are available to anyone including those who have insurance deductibles to satisfy or if they're covered by Medicare as long as the insulin purchases are not submitted as insurance or Medicare claims; users must pay cash). The press release can be viewed at https://www.news.sanofi.us/2022-06-29-Sanofi-to-lower-out-of-pocket-cost-of-insulin-for-uninsured-patients-and-expand-access-in-underserved-communities.

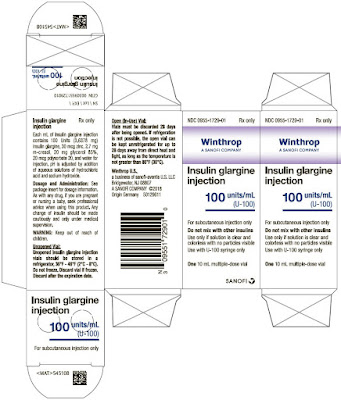

Sanofi has been a laggard relative to its rivals Lilly and Novo Nordisk. For example, in 2019, both Lilly and Novo Nordisk each announced plans to introduce lower-priced "unbranded" prandial insulin analogue products which are not impacted by PBM rebating. The NDC number for the Winthrop U.S. Insulin Glargine Injection U-100 vial is NDC Code 0955-1729-01. That could be relevant if you wish to buy the unbranded Sanofi non-branded glargine U-100 product and it may prove least costly. Those unbranded efforts have been generally successful in ensuring more widespread affordability (prices are artificially-inflated due to the manner in which pharma commercializes drugs; relying on Pharmacy Benefit Managers ["PBM's"] to secure an exclusive therapeutic class position on drug formularies).

The U.S. FTC recently announced a new policy whereby PBM's and the drug companies which pay legally-exempted kickbacks in the form of "rebates" for exclusive formulary placement may be in violation of several laws, including Section 5 of the FTC Act, Section 3 of the Clayton Act, Section 2 of the Robinson-Patman Act, and the Sherman Act to name several (see the new policy statement at https://www.ftc.gov/system/files/ftc_gov/pdf/Policy%20Statement%20of%20the%20Federal%20Trade%20Commission%20on%20Rebates%20and%20Fees%20in%20Exchange%20for%20Excluding%20Lower-Cost%20Drug%20Products.near%20final.pdf for details).

Regardless of what the FTC may or may not do, since launching in 2020, unbranded insulin now accounts for nearly 1/3 of Lilly's U.S. Humalog sales. Lilly continues to commercialize its newer, still patent-protected, slightly faster prandial analogue branded Lyumjev (as does rival Novo Nordisk with Fiasp). However, Lilly no longer sees paying PBM's legally-exempted kickbacks in the form of multi-billion dollar rebates as a competitive necessity to maintain sales of an insulin which has now lost patent exclusivity.

Lilly found that it was cheaper for the company to simply cut prices on the unbranded insulin to a price of $35/vial with a manufacturer coupon from https://www.insulinaffordability.com/ than it was to increase multi-billion dollar bribes paid to PBM's needed to secure formulary placement. Rival Novo Nordisk is addicted to PBM rebates which is eating into the company's insulin margins forcing it to pursue the GLP-1 market for T2D for most of its profits. It has made no price reductions for Novo Nordisk Insulin Aspart (yet). But, I'm betting the company will simply "retire" Novolog instead. Still, none of the big insulin-makers have reduced insulin prices to $30/vial (which they could; the patents on these insulin analogues have all expired) — which is why the March 3, 2022 Civica biosimilar announcement will undoubtedly add competitive pressures to reduce prices by another $5/vial.

U.S. sales of Sanofi insulins have been declining. In late 2021, Sanofi's bestselling basal insulin analogue branded Lantus was dropped from several big PBM formularies, including both Express Scripts and Prime Therapeutics who both dropped Lantus in favor of Biocon's interchangeable glargine product branded as Semglee which is commercialized by Viatris (for the time-being anyway; Biocon recently acquired that company's share of their joint venture, with access to key staff for a period of 2 years following the closure of that acquisition). The company also sells a separate unbranded glargine biosimilar known (for the time being, at least) as simply Viatris U-100 Insulin Glargine also exists with a lower list price but the price is still quite high, although price comparison sites do not typically include the unbranded product in their searches. Still, the list price is 65% LOWER than the identical, branded product sold as Semglee.

Anyway, Sanofi's Lantus being dropped from two key formularies has cut very deeply into Sanofi's U.S. insulin sales. A complicated spinoff for insulin and other active pharmaceutical ingredients to a new stand-alone company known as Euro API was supposed to occur; although for the time being, the nuts-and-bolts distribution of its insulin still remains with Sanofi. Still, Sanofi's ValYOU coupons aimed mainly at the uninsured market (but available to ANYONE) have been caught in a time-warp with prices fixed at $99/vial while its biggest rivals now have products selling for as little as $35/vial. This is especially notable for Sanofi's prandial insulins (including its proprietary but now out-of-patent Apidra and its biosimilar of Lilly Humalog branded as Admelog). Sanofi has been mainly focused on Lantus, letting those other products fall by the wayside in terms of sales.

As part of this initiative, Sanofi will also introduce an "unbranded" basal insulin analogue (a logo for which is pictured both in the image above, and in the coupon below) which will be called simply Sanofi U-100 Insulin Glargine Injection. The FDA-mandated disclosure insert in the unbranded insulin glargine product discloses the new product is from Winthrop US, which is a separate business unit dedicated to commercializing "authorized generic" products (the FDA defines an "authorized generic" as exactly the same product as an approved branded drug, but is marketed without the brand-name on the label), not too dissimilar to rival's Novo Nordisk Pharma Inc. which commercializes that company's unbranded insulins.

Since Lilly introduced its unbranded insulin lispro in late 2019, it has revealed to company investors that its unbranded insulin called simply Lilly U-100 Insulin Lispro Injection now accounts for nearly 1/3 of the company's U.S. Humalog sales (and that shift has occurred in less than 3 years on the market). In fact, that shift required virtually no marketing, no army of salesmen/saleswomen calling on doctors offices and no costly TV ads. I also estimate that Novo Nordisk's Insulin Aspart Injection likely accounts for about 20% of that company's U.S. Novolog sales because it is 20% more expensive than Lilly's unbranded insulin sells for.

Critics say the big insulin companies' commitment to unbranded insulins are only half-hearted and questionable at best, and appear to be more of a PR move aimed at deflecting criticism away from their role, rather than a core underlying business strategy. For example, none of their newest prandial insulin analogues have unbranded versions, nor do any of their basal insulin analogues (until now, anyway). Therefore, it is perhaps unsurprising that Sanofi's first (and so far, only) unbranded insulin product will only be for insulin glargine.

Regardless, with the new announcement, Sanofi's under-utilized proprietary prandial analogue branded as Apidra [U-100 insulin glulisine rDNA origin] which will soon lose patent exclusivity) will NOT have an unbranded version, although I believe the ValYOU coupons will still work on it.

Starting July 1, 2022, the Sanofi ValYOU https://www.teamingupfordiabetes.com/sanofidiabetes-savings-program manufacturer coupons will enable patients to purchase Sanofi insulin products at a cost of just $35/vial.

As a point of comparison, the lowest price for a branded biosimilar version of glargine known as Semglee can be purchased today from Express Scripts Cash-Pay Mail Order Pharmacy by InsideRx for $86.79/vial, which is considerably more expensive than Lilly Insulin Lispro sells for with a manufacturer coupon at just $35/vial. But the Sanofi announcement will now put more much-needed downward pressure on rival glargine prices whose prices have remained stubbornly-inflated when compared to prandial insulin varieties.

Not ironically, as I have covered in several recent posts this year, on March 3, 2022, nonprofit drug-maker Civica, Inc. announced its intention to commercialize three insulin biosimilars, including one of U-100 glargine for a price of just $30/vial possibly as early as 2024 (assuming it encounters no regulatory delays) promises competitive pressure on big insulin to reduce their prices even further.

The Sanofi move is certainly a step in the right direction after years of doing next to nothing, although it still leaves many unanswered questions about big insulin-makers' long-term commitments to unbranded insulin strategies, and also why their price reductions are only to $35/vial rather than $30/vial?

Still, the price reductions are welcome news for U.S. patients. It will put immediate downward pressure on the prices for Lantus and biosimilars of that product.

No comments:

Post a Comment